You may already know that you pay a monthly premium for Medicare Part B (Medical Insurance) once you sign up for Medicare, but did you know that the amount you pay for Part B varies with income?

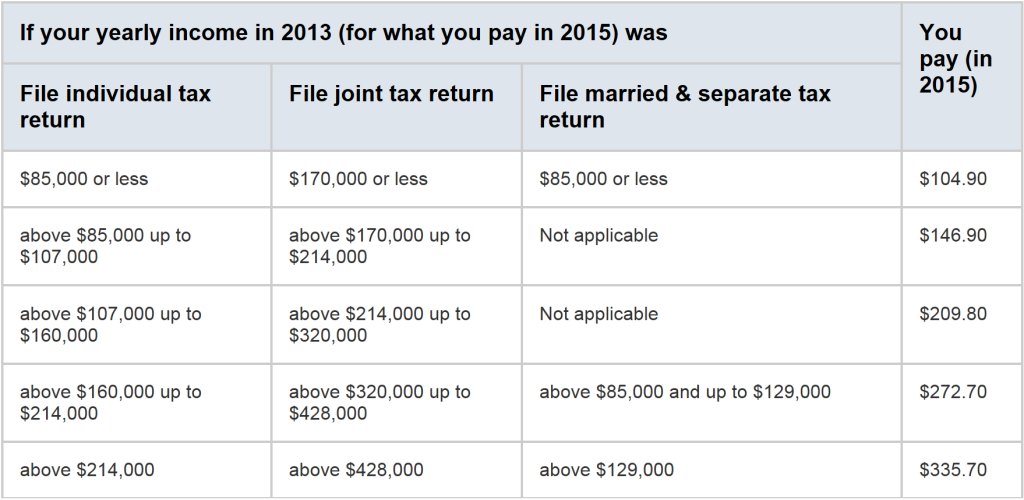

Most people will pay the standard premium amount. However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much does Part B cost?

- Most people pay the Part B premium of $104.90 each month, if you sign up for Part B when you’re first eligible.

- Some people automatically get Part B. Learn how and when you can sign up for Part B.

- If you don’t sign up for Part B when you’re first eligible, you may have to pay a late enrollment penalty. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount, you may pay more.

- Social Security will contact some people who have to pay more depending on their income. The amount you pay can change each year depending on your income. If you have to pay a higher amount for your Part B premium and you disagree (for example, if your income goes down), use this form to contact Social Security.

Part B premiums by income

Late enrollment penalty:

In most cases, if you don’t sign up for Part B when you’re first eligible, you’ll have to pay a late enrollment penalty for as long as you have Part B. Your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it. Also, you may have to wait until the General Enrollment Period (from January 1 to March 31) to enroll in Part B, and coverage will start July 1 of that year.