You’ve paid for Medicare A all your life, and you pay a monthly premium for Medicare Part B when you receive it, but Medicare still doesn’t cover all of your medical expenses…far from it. Your Part A hospital coverage and Part B medical coverage have some significant gaps, and your prescription drug coverage needs to be purchased separately. Below is some information about your cost-sharing requirements under Original Medicare.

Part A costs if you have Original Medicare

Medicare Part A covers the cost for inpatient hospital or mental health facility stays, skilled nursing facilities, home health care, and hospice. However, there are some pretty significant cost-sharing requirements. These gaps in your coverage can easily cost tens of thousands of dollars. To limit their out-of-pocket exposure and protect themselves financially, most people choose to purchase a Medicare Supplement or sign up for a Medicare Advantage plan.

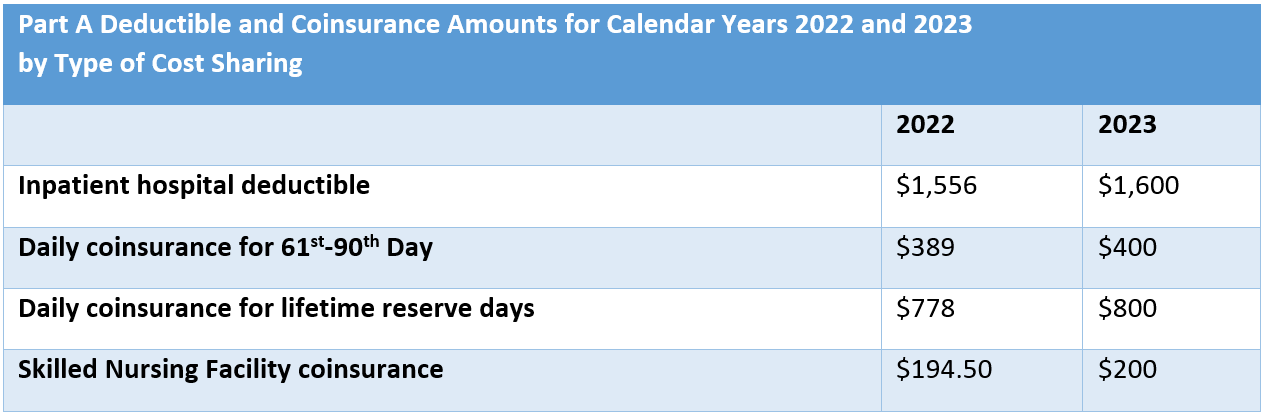

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,600 per benefit period in 2023. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. Beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of hospitalization in a benefit period and $800 per day for lifetime reserve days. For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $200.

- Hospital inpatient stay

- $1,600 deductible for each benefit period.

- Days 1–60: $0 coinsurance for each benefit period.

- Days 61–90: $400 coinsurance per day of each benefit period.

- Days 91 and beyond: $800 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime).

- Beyond lifetime reserve days: all costs.

- Note: You pay for private-duty nursing, a television, or a phone in your room. You pay for a private room unless it’s medically necessary.

- Mental health inpatient stay

- $1,600 deductible for each benefit period.

- Days 1–60: $0 coinsurance per day of each benefit period.

- Days 61–90: $400 coinsurance per day of each benefit period.

- Days 91 and beyond: $800 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime).

- Beyond lifetime reserve days: all costs.

- 20% of the Medicare-approved amount for mental health services you get from doctors and other providers while you’re a hospital inpatient.

- Note: There’s no limit to the number of benefit periods you can have when you get mental health care in a general hospital. You can also have multiple benefit periods when you get care in a psychiatric hospital. Remember, there’s a lifetime limit of 190 days.

- Skilled nursing facility stay

- Days 1–20: $0 for each benefit period.

- Days 21–100: $200 coinsurance per day of each benefit period.

- Days 101 and beyond: all costs.

- Home health care

- $0 for home health care services.

- 20% of the Medicare-approved amount for durable medical equipment.

- Hospice care

- $0 for hospice care.

- You may need to pay a copayment of no more than $5 for each prescription drug and other similar products for pain relief and symptom control while you’re at home. In the rare case your drug isn’t covered by the hospice benefit, your hospice provider should contact your Medicare drug plan to see if it’s covered under Part D.

- You may need to pay 5% of the Medicare-approved amount for inpatient respite care.

- Medicare doesn’t cover room and board when you get hospice care in your home or another facility where you live (like a nursing home).

Source: https://www.medicare.gov/your-medicare-costs/costs-at-a-glance/costs-at-glance.html#collapse-4808

Part B costs if you have Original Medicare

Medicare Part B covers doctor visits both in and out of the hospital and a lot of other outpatient services, including outpatient surgeries, labs and X-rays, home health services, durable medical equipment, and more. The problem is that you pay 20% of the bill for these services with no out-of-pocket limit, and you could pay more if your doctor doesn’t “accept assignment.” A Medicare Supplement or Medicare Advantage plan can fill in some of these gaps and limit your cost-sharing exposure.

- Part B annual deductible:

- You pay $226 per year for your Part B deductible (down from $233 in 2022).

- Clinical laboratory services:

- You pay $0 for Medicare-approved services.

- Home health services:

- $0 for home health care services.

- 20% of the Medicare-approved amount for durable medical equipment.

- Medical and other services:

- You pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you’re a hospital inpatient), outpatient therapy, and durable medical equipment.

- Outpatient mental health services

- You pay nothing for your yearly depression screening if your doctor or health care provider accepts assignment.

- 20% of the Medicare-approved amount for visits to a doctor or other health care provider to diagnose or treat your condition. The Part B deductible applies.

- If you get your services in a hospital outpatient clinic or hospital outpatient department, you may have to pay an additional copayment or coinsurance amount to the hospital. This amount will vary depending on the service provided, but will be between 20-40% of the Medicare-approved amount.

- Partial hospitalization mental health services:

- You pay a percentage of the Medicare-approved amount for each service you get from a doctor or certain other qualified mental health professionals if your health care professional accepts assignment.

- You also pay coinsurance for each day of partial hospitalization services provided in a hospital outpatient setting or community mental health center, and the Part B deductible

- Outpatient hospital services

- You generally pay 20% of the Medicare-approved amount for the doctor or other health care provider’s services, and the Part B deductible applies.

- For all other services, you also generally pay a copayment for each service you get in an outpatient hospital setting. You may pay more for services you get in a hospital outpatient setting than you would pay for the same care in a doctor’s office.

- For some screenings and preventive services, coinsurance, copayments, and the Part B deductible don’t apply (so you pay nothing).