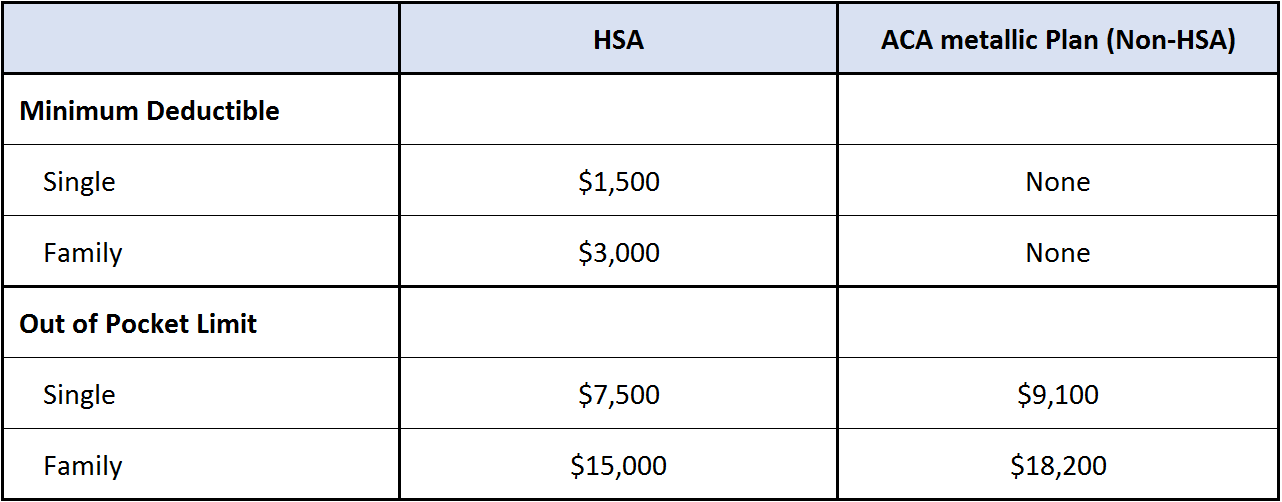

Deductible and Out-of-Pocket Limits

The Internal Revenue Service has announced the deductible, out-of-pocket, and contribution limits for HSA-qualified plans for the 2023 calendar year. The minimum deductible increased from $1,400 to $1,500 for people with single coverage and from $2,800 to $3,000 for people with family coverage, compared with 2022. (The minimum individual deductible on an embedded deductible plan is $3,000, the same as the minimum family deductible.)

The out-of-pocket limit increase is even more significant, from $7,050 in 2022 to $7,500 in 2023 for people with single coverage, and from $14,100 in 2022 to $15,000 in 2023 for people with family coverage.

The out-of-pocket exposure for non-HSA-qualified metallic plans is now much higher than for “High Deductible” HSA plans. For individuals, the 2023 out-of-pocket limit is $9,100 (up from $8,700 in 2022), and for families the 2023 OOP limit is $18,200 (up from $17,400 in 2022). The new figures are summarized in the chart below.

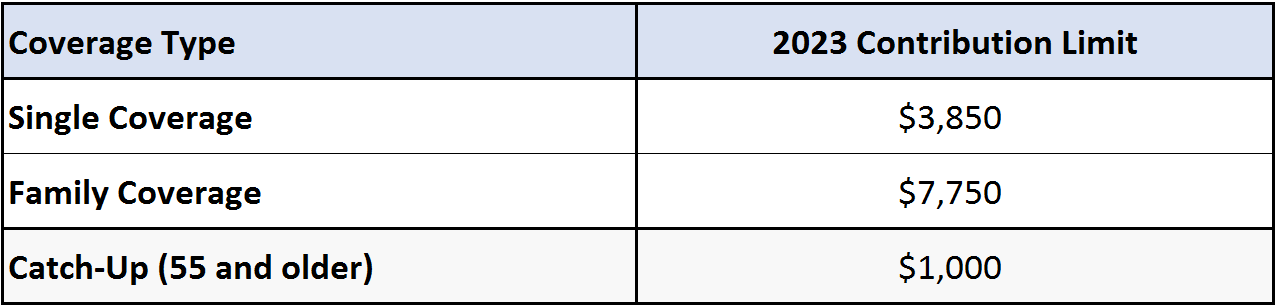

Contribution Limits

People with an HSA-qualified High Deductible Health Plan who do not have other coverage that pays prior to the deductible can set aside tax-free dollars to pay for eligible medical expenses. The 2023 HSA contribution limits are summarized in the chart below. There’s a $200 increase for people with single coverage (from $3,650 in 2022 to $3,850 in 2023) and a $450 increase for people with family coverage (from $7,300 in 2022 to $7,750 in 2023).

If you have questions about Health Savings Accounts or are interested in one for your family or your employees, please contact JME Insurance at 972.245.0266.