JME Insurance Agency has had a long-time relationship with TWM and is happy to assist with the health insurance needs of your small group, individual, and Medicare clients. On this page, you’ll find information about the small group quoting, submission, and renewal process; the individual market, including on-exchange and off-exchange products; and the Medicare market, including Medicare supplements and Medicare Advantage plans. It is meant as a quick resource that should save you time when working with your clients, but, as always, you can contact JME for assistance. We’ll begin with a couple videos from our July 12, 2023 training session.

2023 Small Group, Individual, and Medicare Update

On July 12, 2023, JME participated in a lunch and learn at the Tolleson office. Below are two video updates that we played during the meeting.

SMALL GROUP

Small Group Eligibility

- Small group health plans are guaranteed issue for employers with 2-50 total employees. This means that there are no medical questions to answer and no pre-existing condition exclusions, limitations, waiting periods, or surcharges.

- To qualify as a small employer, there must be two eligible people. This could be two owners, two full-time W-2 employees, or one owner and one W-2 employee.

- Full-time is defined as averaging 30+ hours per week.

- If the group is set up as an LLC filing as a partnership (meaning the group will file a Form 1065 each year), then a group with two human owners (as opposed to an LLC owned by one human owner and another business) would be eligible. If the group is set up as a sole proprietorship (meaning the owner just files a schedule C with his/her taxes) or as an S-Corp, then there needs to be at least one full-time W-2 employee in addition to the owner(s).

Getting a Quote

- Gettng a quote is easy. We just need the name and zip code of the company, the industry or SIC code, and the name, gender, and age or DOB of each employee and dependent that wants to be covered.

- You can download a Quote Request Form here to help collect the necessary information.

- JME will send you a one-pager with a variety of plans to choose from, including PPO and HMO plans, copay and HSA plans, and various deductible and out-of-pocket options. An agent will be happy to discuss the plan options with you over the phone and will make a recommendation for your client.

Helping you client select the right carrier and plan(s)

- We usually recommend that a client select multiple plan options for the employees to choose from, and we can help you with those selections. This is beneficial because it can help lower the required employer contribution (the employer must contribute at least 50% of the employee premium for the lowest-priced plan offered, so employers that want to reduce their required contribution should select a lower-priced HMO plan as their base plan option). It also gives new employees a variety of plans to choose from.

- Blue Cross Blue Shield of Texas (BCBSTX) will allow small employers to offer up to 6 plan options. Baylor Scott & White (BSW) will allow an employer to offer up to three.

- BCBSTX and BSW are the two most competitive carriers in all markets. UnitedHealthcare (UHC) is a distant third. Aetna only offers 2-4 health plans (depending on location), and they are very uncompetitive. Humana is also very uncompetitive, and they have announced that they are pulling out of the group health market at the end of 2023. Memorial Hermann only offers 6 plans and only in a few counties in the Houston area.

- The vast majority of our clients choose BCBSTX. In fact, almost 90% of small group plans in Texas are with BCBSTX. They have compeititve rates and a statewide HMO plan.

- BSW will be more compeitive than BCBSTX on their PPO plans, but they do have a much smaller provider network. Clients who already use Baylor Scott & White hospitals and doctors might do well with BSW, but most other clients will prefer the larger network that BCBSTX offers, which includes most of the BSW providers plus a lot more.

- BCBSTX is also the only small group carrier that will allow a “group of one.” This means that if there are two owners, one could waive coverage and the other could enroll. Or, if it is a husband-and-wife business, they could enroll together as a family with no additional member enrollments required.

- We are big fans of Health Savings Account (HSA) compatible plans. While these plans do not have up-front, flat-dollar copayments for doctor visits and prescriptions, they tend to be lower in price than copay plans. They also have lower out-of-pocket exposure than many of the copay plan options, and they allow the member to set up a tax-advantaged Health Savings Account and contribute tax-free dollars.

- A lot of our clients also go with HMO plans. While an HMO does not have an out-of-network benefit, uses as smaller provider network, and requires referrals from the primary care physician if the member needs to see a specialist (those are the negatives), the HMO network with BCBSTX is pretty large, and the prices of the BCBSTX HMO plans are about 35% lower than the comparable PPO plans.

Small Group Paperwork

- We prefer to receive group submissions at least 10 days prior to the effective date. That should allow enough time for the group to be reviewed and approved and temporary ID cards issued before the plan goes into effect.

- If your client selects BSW or another carrier, we can provide you with the paperwork. The below instructions are for BCBSTX.

- Every group must complete a Benefit Program Application (BPA) form, or employer app. This document is long, but answer the questions as best you can and we can help with any missing info. Signatures are the most important. Most pages don’t require much info, so it’s actually shorter than it looks. The proxy form is optional – BCBSTX requests it because they are a mutual legal reserve company. The last two pages only need to be completed if the group is offering one or more HMOs. One of the commonly missed questions is the ERISA question. Enter the company name as the plan sponsor, the plan effective date as the ERISA start date, and the end date should be one date before the renewal next year. For instance, 10/1/2023 – 09/30/2024.

- Every group must also complete the Employer Group Information (EGI) form. This one is pretty easy. Most of the answers on the front page will be no. If the group has fewer than 20 employees, the answer to the COBRA question on page 2 will be no. When the employer signs on page 3, be sure to include the title.

- Unless the group files a Texas Workforce Commission (TWC) report and everyone who is eligible is on that form, the groupw ill need to complete the Texas Supplemental Employment Verification (TSEV) form. Anyone not on the TWC must be listed on the form, including any owners and any full-time employees who are not yet on the TWC.

- Each owner and each full-time (30+ hours / week) employee must complete an Employee App and Waiver Form either accepting or declining coverage. Section 2 and 3 will need to be completed on page 1. Section 4 will need to be completed on page 2. If anyone is waiving coverage, section 8 will need to be completed on page 2. And the employee must sign and date the form. If a husband and wife are both eligible as owners or employees and are enrolling as a family, then the one who is not the primary member will need to complete a form waiving coverage. For example, if the husband covers his wife as a dependent, then the wife will need to waive coverage on her own form.

- Finally, there is an Employer Representative Authorization form that will give TWM authority to act on the client’s behalf.

- If the group is an LLC filing as a partnership, we will need a copy of the K-1s for each partner (with ownership adding to 100%). If the company is new and has not yet filed its first tax return, then we will need a copy of the Certificate of Formation that was filed with the Secretary of State’s office and the Certificate of Filing from the Secretary of State that confirms the paperwork was received and filed. We will also need the page from the partnership agreement that shows the initial members and ownership percentage. And we will need a copy of the EIN letter received from the IRS. It should show that the group will need to complete form 1065 (by March 15 of the following year. That will be sufficient documentation for the owners.

- For any W-2 employees, the group should be filing a quarterly TWC report. We’ll need a reconciled copy of the most recent report (showing FT for full-time, PT for part-time, or T for termed along with the termination date). If the group does not yet have a TWC report, we will need a copy of each full-time employee’s W-4 and a copy of a payroll stub showing federal income taxes and SS/Medicare taxes being withheld.

- If the group is a proprietorship, we’ll need a copy of the owner’s schedule C and documentation for at least one employee. If the group is an LLC filing as an S-Corp, we’ll need the same LLC paperwork for the owner plus the documentation for one W-2 employee. BCBSTX has a weird rule – if it is a new S-Corp, then they can write it with proper documentation. But if it is not a new S-Corp, they won’t allow the group to be effective the year they hire their first W-2 employee. For instance, if the S-Corp was formed in 2022 and they hired their first W-2 employee in 2023, the group could not get a 2023 effective date; they’d need to wait for a 2024 effective date.

Employee Packet

- If the group makes decisions about its plan selection, rating methodology (age or composite), employer contribution, new hire waiting period, etc. far enough before its effective date, we will prepare an employee benefits packet ahead of time to help employees and owners with their plan decisions. Otherwise, we will create an employee packet after the paperwork has been submitted to share with current employees and any new hires.

- We will also prepare an employee packet each year at renewal time once the employer has decided if there will be any plan changes.

- The employee packet includes a checklist for the employees, a cost sheet, an employee election form, the carrier’s enrollment form, the summary of benefits and coverage (SBC) for each plan offered, several compliance documents, and more. Only a few pages need to be printed, but the packet should be distributed to all eligible employees as employers are required to provide many of these documents to employees on an annual basis.

- At renewal time, the one-page election form is all that needs to be returned for most current employees to indicate their plan selection (or waiver) for the next plan year. This makes it quick, easy, and painless to renew a group.

- The packet also contains a link to an online benefits portal that we’ve created which provides additional information for employee, including info on additional perks they are eligible for (like vision discounts). Here is the link for a group with fewer than 20 employees that offers an HSA-qualified plan.

Group Approval

- When a group plan is approved by the carrier, we will send the Welcome Letter via secure email. It confirms the rates and provides the group number.

- In the same email, we will include a Blue Access for Employers (BAE) quick start guide if they go with BCBSTX. BAE is the employer portal. Through it, employers can download bills and pay their monthly invoice or set up auto-draft, add and delete employees, and more. The group will need to designate a BAE Administrator on their Benefit Program Application. We would suggesting making the employer the BAE contact, and then access can be granted to Tolleson.

- We will also attach information on Senate Bill 51 to the welcome email. Senate Bill 51 in Texas requires employers to terminate employees in a timely fashion. Employee terminations can only be backdated 3 business days into the month; after that, the employer will be responsible for that employee’s premium for the next month. The carriers usually do not grant exceptions to this requirement.

- We will email temporary ID cards when available. That’s usually a couple days after the group is approved. The employees should receive their physical ID cards in the mail in 10-14 days.

- In a separate email, we will send the employee benefits packet, as mentioned above (if not already provided).

- We will also send the Broker Compensation Disclosure email. This is a requirement, and since we are not communicating directly with Tolleson clients, it is very important that this email be forwarded on. Here is some information on the Broker Compensation Disclosure.

Communications During the Year

- As with the Broker Copmpensation Disclosure form, there are some other communication requirements or required notices that must be provided to or completed by employer groups during the year. Again, we will rely on Tolleson to ensure that this information is provided to your clients.

- BCBSTX does require two forms to be completed during the year: the SBC Monitoring Performance and the Medicare Secondary Payer Notice. Both of these are completed through the BAE employer portal.

- The SBC Monitoring Performance requires employers to confirm to BCBSTX that the Summmary of Benefits and Coverage (SBC) forms were provided to the employees at renewal time along with the method of delivery. Those are included in the Employee Packet, so this is an easy requirement to comply with as long as the employee packet is distributed and the employer completes the confirmation form through the employer portal.

- The Medicare Secondary Payer Notice requires employers to verify their employee count on an annual basis. This is necessary to determine whether Medicare or the group plan is the primary payer when an employee has both types of coverage. (Medicare is primary for groups under 20; the group plan is primary for froups of 20+.)

- When an employee terminates coverage, the employer is responsible for providing them with either the COBRA or State Continuation election notice (COBRA for groups of 20+, state continuation for groups under 20).

- Additionally, there are occasional notices and updates that need to be provided to employers. We will notify you if that’s the case. For example, there was a (hopefully) one-time government requirement in 2023 for employers to notify the carrier about the average premium paid by employers and employees for employee and dependent coverage.

Group Renewals

- Employer groups renew each year at the same time, one year after their initial effective date.

- The group renewal is provided by the carrier about two-and-a-half months before the renewal date. We will share the renewal offer and, a few days later, alternate quotes along with or recommendations. We will also try to set up a phone call to discuss.

- The employer can make multiple changes at renewal time, including changing the plans that are offered, the new-hire waiting period, the rating methodology, and more. Any of these changes can be requested on an amendment form, which must be submitted no less than 30 days before the renewal date.

- Once the employer has made the renewal decision, we will prepare and send an employee packet. Please forward this to your client for distribution to employees.

- The employees then have a 31 day open enrollment period (which is why an early decision is necessary) to decide which plan they want to go with for the next year and whether they want to cover dependents, etc. They will indicate their decision on the one-page election form. For most employees, that’s the only form we need returned. For those with an HMO, there is a separate PCP form to be completed if they want to change primary care physicians.

- We will review the election forms and make any necessary changes in the carrier’s system. For anyone changing plans, we’ll send a confirmation form and a temporary ID card for the new plan. New ID cards will be ordered and sent by mail.

JME can help!

- During the year, JME can assist with adds and deletes.

- We can also assist with elevated customer service issues.

- Unless you tell us otherwise, we will not communicate directly with clients, but we are happy to do so if you would prefer that at any point.

INDIVIDUAL

ACA-Compliant Individual Plans

- Individual plans compliant with the rules of the Affordable Care Act (ACA) can be purchased “On-Exchange” or “Off-Exchange.” On-Exchange means the plan is purchased through Healthcare.gov. These are the plans that offer a premium tax credit to help pay for the cost of health coverage for those who qualify. Off Exchange means the plan is purchased directly from the health insurance company, outside Healthcare.gov. Either way, the plans are fairly similar, but for 2024, insurance companies will be limited to 8 offerings through Healthcare.gov – 4 standard plans, and 4 additional options.

- Unfortunately, all ACA-compliant individual plans currently available in Texas only use an HMO network; no PPO options are available.

- And many individual plans have more restricted HMO networks than are available to group clients, even those offered by big-name carriers. For example, UnitedHealthcare uses primarily Medical City and Methodist hospitals.

- In contrast, BCBSTX uses the Blue Advantage HMO network (the same network available to small group plans). It is more extensive and is available across the state. Most carriers have a regional rather than a state-wide HMO.

- For clients who really want a PPO, one is availale through UnitedHealthcare, but this is for a short-term health plan. These plans are not ACA-compliant and do not cover all of the same benefits an ACA-compliant plan does. They tend to have higher out-of-pocket exposure, do not cover pre-existing conditions, and do not cover preventive care. The applicant will have to answer a few medical questions and could be turned down for the policy. These plans can last for a maximum of one year and can be renewed up to three years. Each time they are renewed, they’ll have to go through underwriting again and their deductible and OOP maximum will be re-set. Short-term plans can be purchased all-year long.

- ACA compliant plans can only be purchased during the Open Enrollment Period from November 1 through January 15 each year. Individuals who apply from Nov 1 to Dec 15 will have a Jan 1 effective date. Individuals who apply between Dec 16 and Jan 15 will be effective Feb 1.

- Those who have a “qualifying event” during the year (like loss of group coverage, end of COBRA, aging off a group plan, divorce, birth of a baby, or moving to a new area) will qualify for a 60-day Special Enrollment Period (SEP) of 60 days, during which they can apply for coverage in the individual market.

Which option is the best for a client?

Some clients who initially may think they need to purchase an individual plan might be surprised to learn that they have several options:

- COBRA: COBRA is simply a continuation of an employee’s group coverage after they leave employment (with no contribution from the employer). If COBRA is available, it is often comparably priced with individual coverage (assuming no premium tax credit is available) and may offer better benefits and a better network than the individual plans we can offer.

- Individual Coverage: For those who qualify for a premium tax credit, an individual policy is likely a lower-priced option than COBRA. Note that the individual might choose an individual health plan but may want to keep COBRA for dental and vision coverage since the premium tax credit does not help with that.

- Short-Term Coverage: Again, this could be a lower-priced option for someone who does not qualify for a premium tax credit and does offer a PPO network, but it’s not as comprehensive as either an individual plan or a group plan, so it likely isn’t a great long-term solution.

- Small Group Coverage: Some clients have a company and will qualify for a small group plan, giving them access to more options, including PPOs.

Premium Tax Credits

A premium tax credit offers financial assistance to certain individuals who purchase individual policies through Healthcare.gov based on their age, family size, and household income.

- Is is important to note that these premium subsidies are based on income, not wealth. That means that some TWM clients with significant income could still qualify for a premium tax credit as long as their income is low enough.

- Use the quick link on our website to check if a premium tax credit is likely under current rules: https://jmeinsurance.com/kff-subsidy-calculator/

- Here’s an Example: A 63-year-old couple in Dallas earning $100,000 per year would qualify for a premium tax credit of $1,335 per month ($16,021 per year) to help them pay for their coverage.

- For those who do not qualify for a subsidy, the enrollment form is the same all year. Clients will purchase an “off exchange” plan.

- To receive a subsidy, the client must enroll through the health insurance marketplace, healthcare.gov. We can assist but cannot do for them. This is a Healthcare.gov rule.

MEDICARE

When clients near age 65, they are bombarded with information about their options – by mail, by phone, by friends and family members, on TV, etc. That’s why it’s beneficial to share information with them early so they know about their options and can tune out the other noise. Below is some detailed information that you may want to consider sharing with your clients. Note that the Medicare supplement application differs for individuals applying during their Medicare supplement general enrollment period (the first 6 months after signing up for part B) and for those applying outside of this period.

Signing Up for Medicare

You will soon be turning 65, and that means you will be eligible for Medicare on the first day of the month in which you turn 65. The first step is signing up for Medicare parts A and B, which you can do starting three months before your Medicare eligibility date.

Note 1: If someone’s birthday is on the 1st of the month, he/she will be eligible for Medicare the 1st of the previous month.

Note 2: For someone applying after age 65, Part B should be effective the 1st of the next month after it’s approved. Medicare Part A will be backdated by up to 6 months (but not before the client’s 65th birthday). Because the Part A effective date is backdated, it could impact the client’s HSA eligibility and maximum contribution amount for the year.

To apply for Medicare, you can go to www.ssa.gov or call Social Security at 800.772.1213.

You’ll need both Parts A and Part B to obtain either a Medicare Supplement or a Medicare Advantage plan. Those are explained below.

Understanding Original Medicare (Parts A and B)

Medicare is a government program for people over the age of 65, people on Social Security Disability, and people with End-Stage Renal Disease (ESRD).

It is not a handout; instead, it’s something you’ve paid for during your working years and something you’ll pay for when you turn 65 and begin receiving benefits.

When you’re working, 1.45% of your income goes to pay for Medicare Part A (2.9% if you’re self-employed). When you turn 65, Part A is free as long as you’ve contributed to the Medicare program for 40 quarters (10 years), or if you’re married to someone who’s contributed for that amount of time, but you’ll continue to pay the 1.45 (or 2.9) percent your income as long as you’re working.

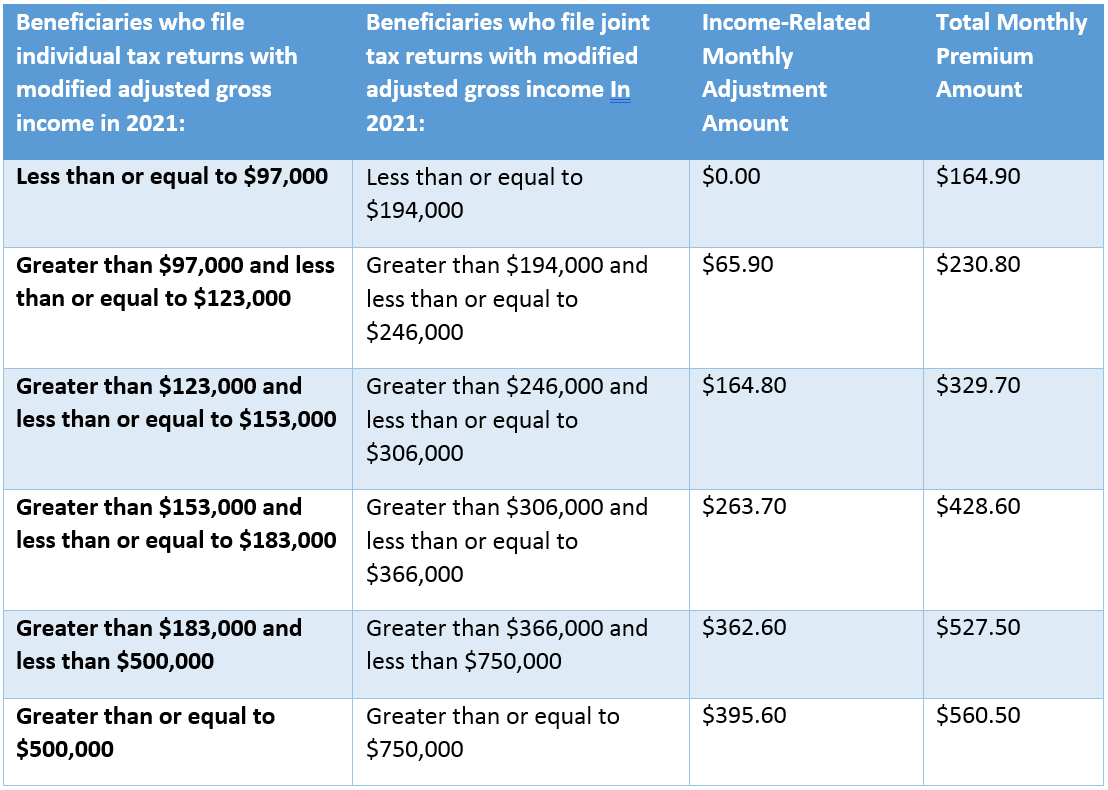

Part B of Medicare is something you pay for when you start receiving it. The amount you pay depends on what your income was two years ago, so the 2023 premium is based on your 2021 income. Here’s a chart that shows you the amounts:

It is possible to appeal an IRMAA determination if your income decreases in 2023 from 2021. Click here for more information: https://www.hhs.gov/about/agencies/omha/the-appeals-process/part-b-premium-appeals/index.html

Medicare has lots of holes

Unfortunately, Medicare alone is not enough. Medicare Part A (which covers hospital facility costs, skilled nursing facilities, home health, and hospice) has a big hospital deductible of $1,600 that can hit multiple times in a year, copayments of $400 per day after day 60, copayments of $800 per day after day 90, and no coverage at all after 150 days in the hospital. These are the 2023 amounts – they go up every year.

For Part B of Medicare (which covers doctor visits in or out of the hospital and outpatient services like rehabilitation, chemo, radiation, dialysis, and medical equipment), has an annual deductible of $226, then you pay 20% of the bill after that with no out-of-pocket limit – the 20% goes on forever.

To help reduce your risk, you need something other than original Medicare. There are two options, a Medicare Advantage plan or a Medicare supplement, also called a Medigap plan.

Medicare Advantage Plans

A Medicare Advantage plan is basically a health plan offered by a private insurance company that takes over the administration of your Medicare benefits. When you sign up for an Advantage plan, you won’t use your Medicare card when you receive medical services – you’ll use the card that the insurance company gives you.

Many Advantage plans are HMOs, so you’d need to choose a primary doctor and get a referral to see a specialist. Others are PPOs, which do not require a primary care physician or referrals, but you’ll still need to stay in the provider network to receive the best benefits.

The good thing about Advantage plans is that most have a low or even $0 monthly premium (you just have to keep paying your Part B premium). The bad thing is that they have cost sharing in the form of copayments, a calendar year deductible, and coinsurance after the deductible. But they do have an out-of-pocket limit, so you have more protection than with Medicare alone.

The reason they’re called Advantage plans is because, in addition to providing everything Medicare does and capping your out-of-pocket spending, these plans also usually include some extra perks like dental or vision coverage. These are the programs you’ve probably seen old celebrities advertising on TV.

Advantage plans are “guaranteed issue,” meaning that they don’t ask medical questions, and you can’t be turned down because of pre-existing conditions.

To learn more about Advantage plans, you may want to take a look at this resource from Medicare.gov: Understanding Medicare Advantage Plans

Note 3: JME does not actually sell Medicare Advantage plans but does have a relationship with an agent who can assist if necessary.

Medicare Supplements

A Medicare supplement is also known as a Medigap plan. With a supplement, you still use your Medicare card and the government still pays its amount, but then the supplement fills in the holes, or at least most of the holes.

We normally recommend a Plan G supplement, which fills all of the gaps in original Medicare with the exception of the Part B deductible ($226 in 2023). So, for any covered service, that’s all that you would pay for the year. Obviously, that’s much better than most employer-based or individual health plans. The Medicare supplement rates for various ages can be found in this rate guide:

You do have other Medigap options, but we like BCBSTX for a couple reasons: 1) Our clients have had a good experience with them. 2) They have a history of reasonable rate increases.

Medicare supplements are guaranteed-issue for the first 6 months after you sign up for Medicare Part B. After that, if you wanted to buy a supplement or switch to another one, you’d have to answer medical questions and could be turned down. For that reason, people tend to stick with their supplement for a long time, which means that the year 1 rate isn’t as important as the rate increases over time. As you get older, the rates will go up with every insurance company, but it’s a good idea to pick one with a history of more moderate increases.

One other good thing: If you were enrolled in a BCBSTX group or individual policy 12 months prior to your Medicare Supplement effective date, you will qualify for a 7% discount. Or, if you lived with someone else age 60 or over for the past 12 months, you will qualify for a 10% household discount. (Only one discount will apply.)

Click here for the Blue Cross Medicare Supplement application. As you can see, it’s not too difficult to complete.

BCBSTX Guaranteed Issue Application

BCBSTX Underwritten Application

Medicare Part D Drug Plan

If you do move forward with a supplement, you will also need to apply for a Part D prescription drug plan. These are built into many Medicare Advantage plans, but a supplement does not include drug coverage.

The good news is that most drug plans are pretty affordable – the majority of our clients end up spending less than $30 per month for drug coverage. We can do a search on the Medicare.gov website based on your current prescriptions and your preferred pharmacies.

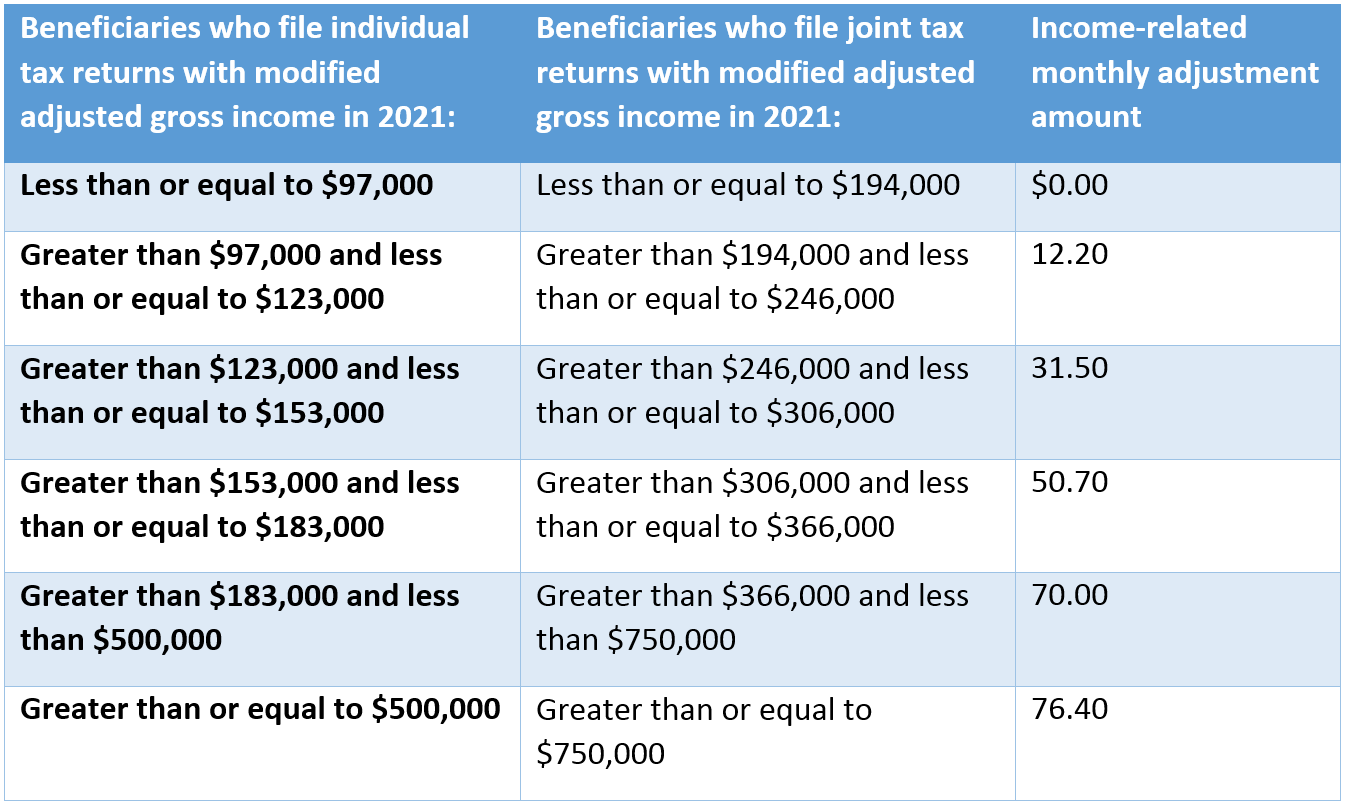

Just like with Part B, people over a certain income level do pay an additional surcharge on top of their monthly Part D drug premium. The below chart shows the extra charge at different income levels.

The good news is that searching for and enrolling in a Medicare Part D drug plan is pretty quick and easy through the Medicare.gov website. You just need to enter your zip code and the names and dosages of any prescriptions you’re currently taking. You can also select the pharmacies you’d like to use if you’d like. You’ll then see a list of all of your Part D options in order by total expected premium + out-of-pocket expense through the end of the year. We would suggest going through this search process each fall as your drugs or the available drug plan options may change.

Here is a short video showing exactly how to shop for a Part D drug plan on the Medicare.gov website, followed by step-by-step instructions.

Step-by-Step Instructions

- To begin your drug plan search, go to https://www.medicare.gov/plan-compare

- If you are already enrolled in a Medicare Part D plan, you can log in to the site. The prescriptions you have taken will already be loaded in, so you can simply edit the list and search for a plan. If you do decide to switch to a different plan, some of your information will already be entered, making the application process even quicker. If you don’t have a login, you can create one. If you are new to Medicare or do not wish to create a login, you can continue without logging in.

- I answer to the question “What type of 2022 coverage are you looking for?” on the next page, select “Drug plan (Part D).”

- Enter your zip code and select your county.

- If you receive help paying for prescriptions through Medicaid, a Medicare Savings Program, etc., select the appropriate option when asked “Do you get help with your costs from one of these programs?” If you do not receive any extra help, select “I don’t get help from any of these programs.”

- On the next page, you’re asked “Do you want to see your drug costs when you compare plans?” Say yes. This will allow you to enter the names of any prescriptions you currently take and have those costs shown in the search results. You should review your options to ensure you have the best plan based on your current prescriptions and/or the prescriptions you know you will obtain this calendar year.

- Begin typing in your prescriptions on the next page. You should be able to enter the name of the drug, or even part of the name, and then select your prescription from the drop-down list that appears. Click the green “Add Drug” button, then select your dosage, quantity, and frequency. For instance, if you take one pill per day, you would select 30 per month. If you take two pills per day, you would select 60 per month. Click the green “Add to My Drug List” button.

- You can then add another drug if you have more medications. If you are aware of any potential drug change in the coming year, you may also want to enter it to see how that prescription can impact your selection. Note that OTC drugs (over the counter) are not covered and should not be entered. Do not enter scripts that are not covered by any of the Part D carriers, such as Cialis, since they are not considered medically necessary and will not be on any formulary. Non-covered drugs can skew the pricing results of the drug cost for the remainder of the calendar year.

- When you are done, click the green “Done Adding Drugs” button.

- On the next page, you can select up to 5 pharmacies. While you might have a favorite pharmacy, we would suggest that you add a few others. The reason is because the price of some medications will differ depending on the pharmacy you use. Also, some drug plans have preferred prices at specific pharmacy and may even include the pharmacy name in the name of the plan. One of the options you can add is “Mail Order Pharmacy.” Since most drug plans have a mail-order option, we would suggest that you choose this as one of your five pharmacies so you can compare the costs of your drugs if ordered by mail with the cost at a retail pharmacy. The name of the pharmacies you select will appear at the bottom of the screen. When you are finished adding pharmacies, click the “Done” button in the lower right corner.

- The results will appear on the next page, and there are a few different sorting options. We would recommend that you sort by lowest drug + premium cost because that will display the total amount you can expect to pay through the end of the year (based on your current prescriptions). Sometimes, selecting a plan with a higher premium will save you money if the cost-sharing on that plan is lower. If you did not log in, the lowest-priced plan will be at the top. If you did log in, your current plan will be shown at the top, followed by your other options, arranged lowest-to-highest price.

- When comparing plans, the premium, the price for your prescriptions, and the plan’s formulary of the drugs they cover are the three important pieces to consider. To learn more about a particular plan, you can click the blue “Plan Details” button.

- If you have questions or have difficulty, please call 1.800.MEDICARE for assistance in selecting and enrolling in a Part D plan. Or, if you know which plan you want, you can call the carrier (insurer) for assistance.

- When you have made a decision, click the green “Enroll” button. A pop-up will advise you that you need to have your Medicare Number and effective dates handy along with information about your other health coverage (if any), including policy and group numbers, and the dates that any changes take effect, like if you’re moving to a new area or into a long-term care facility.

- The enrollment process is pretty straightforward, but, again, contact the carrier if you need assistance. When you are done and click “Submit,” be sure to print and save the confirmation page – that is your proof that you enrolled in a plan.

- In a few days, you should receive a letter from the insurance carrier confirming your plan selection. The invoice and ID Card will come later. If you have questions, please call your Part D insurance carrier using the phone number on the letter or ID card.

We know this is a lot of info, but hopefully it will be helpful. Again, please let us know if we can answer any questions for you or be of any assistance. Thank you!