- What is Medicare?

- What does Medicare Part A cover?

- How do I get Medicare Part A and how much does it cost?

- What does Medicare Part B cover?

- How do I get Medicare Part B and how much does it cost?

- What type of gaps exist in my Medicare coverage?

- What is a Medicare supplement and why do I need one?

- What is Medicare Part D and how much does it cost?

- What is a Medicare Advantage plan?

- Medicare & You 2018

WHAT IS MEDICARE?

Medicare is a government-run insurance program for people age 65 and older, people on Social Security disability for two or more years, and people with end-stage renal disease (ESRD).

Medicare just turned 50! The program was signed into law in 1965 and as been modified several times over the years, most significantly by the Balanced Budget Act of 1997, which created Medicare Advantage Plans, and the Medicare Modernization Act of 2003, which created Medicare Part D Prescription Drug Plans.

There are two parts to “Original Medicare”: Medicare Part A Hospital Coverage and Medicare Part B Medical Coverage. Unfortunately, Medicare alone is not enough, so most people choose to protect themselves by purchasing a Medicare supplement or signing up for a Medicare Advantage plan.

WHAT DOES MEDICARE PART A COVER?

Medicare Part A is known as your “hospital coverage.”

In general, Part A covers:

- Inpatient hospital care

- Skilled nursing facility care

- Nursing home care (as long as custodial care isn’t the only care you need)

- Hospice

- Home health services

Two ways to find out if Medicare covers what you need

- Talk to your doctor or other health care provider about why you need certain services or supplies, and ask if Medicare will cover them. If you need something that’s usually covered and your provider thinks that Medicare won’t cover it in your situation, you’ll have to read and sign a notice saying that you may have to pay for the item, service, or supply.

- Find out if Medicare covers your item, service, or supply.

HOW DO I GET MEDICARE PART A AND HOW MUCH DOES IT COST?

During your working years, you pay 1.45% of each paycheck (and that amount is matched by your employer) to pay for Medicare Part A. You earn “premium free” Part A by contributing to the Medicare program for 40 quarters (the equivalent of 10 years) or being married to someone who has. Individuals who did not contribute to the Medicare program for the required length of time can purchase Part A directly from the government.

Generally, Medicare Part A starts automatically when you turn 65 if you’re already receiving Social Security. If you’re not yet receiving Social Security at age 65, you can sign up for Medicare Part A at your local Social Security office. Individuals who have been on Social Security Disability for two years or who have been diagnosed with End-Stage Renal Disease (ESRD) can also qualify for Part A.

About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to receive coverage under Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $227 in 2017, a $1 increase from 2016. Uninsured aged and certain individuals with disabilities who have exhausted other entitlement and who have less than 30 quarters of coverage will pay the full premium, which will be $413 a month, a $2 increase from 2016.

WHAT DOES MEDICARE PART B COVER?

Medicare Part B is known as your “medical coverage.”

Part B covers 2 types of services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts assignment.

Part B covers things like:

- Doctor visits (both in and out of the hospital)

- Outpatient surgery

- Clinical research

- Ambulance services

- Durable medical equipment (DME)

- Mental health (Inpatient, Outpatient, Partial hospitalization

- Getting a second opinion before surgery

- Limited outpatient prescription drugs

Two ways to find out if Medicare covers what you need

- Talk to your doctor or other health care provider about why you need certain services or supplies, and ask if Medicare will cover them. If you need something that’s usually covered and your provider thinks that Medicare won’t cover it in your situation, you’ll have to read and sign a notice saying that you may have to pay for the item, service, or supply.

- Find out if Medicare covers your item, service, or supply.

HOW DO I GET MEDICARE PART B AND HOW MUCH DOES IT COST?

Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B. Learn how and when you can sign up for Part B.

If you don’t sign up for Part B when you’re first eligible, you may have to pay a late enrollment penalty.

How much does Part B cost?

About 70% of Medicare beneficiaries will pay the standard amount of $109 in 2017 (up from $104.90 for the past four years). These include people who 1) are not new to Medicare and who 2) receive Social Security benefits.

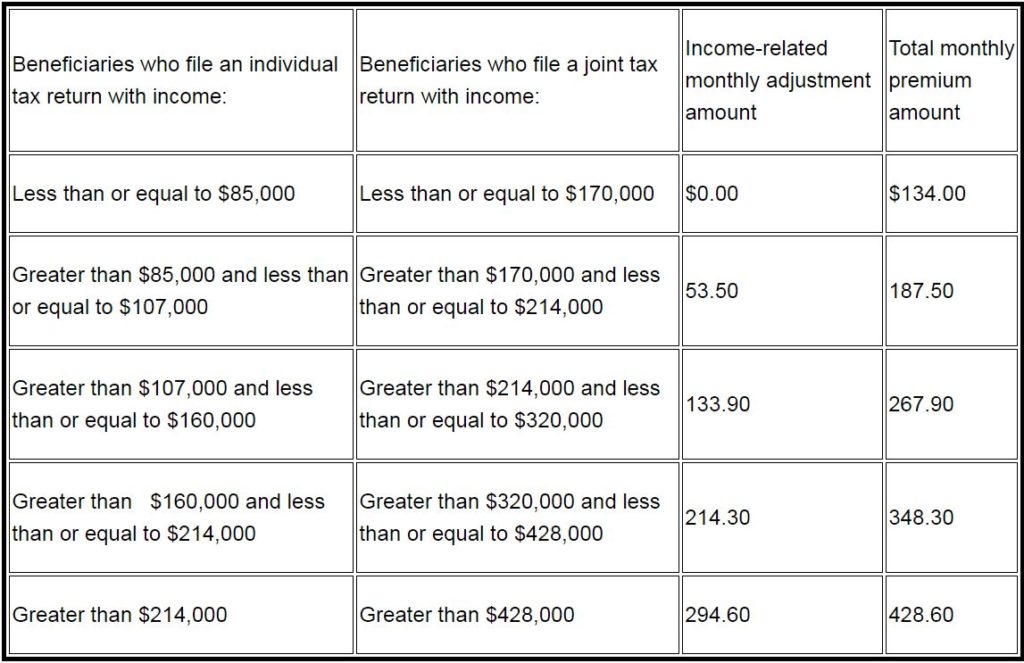

About 30% of Medicare beneficiaries will pay more, including beneficiaries who do not receive Social Security benefits, those who enroll in Part B for the first time in 2017, those who are directly billed for their Part B premium, and those who are dually eligible for Medicaid and have their premium paid by state Medicaid agencies. For these individuals, the base amount for 2017 is $134 (a 10 percent increase from the 2016 premium of $121.80).

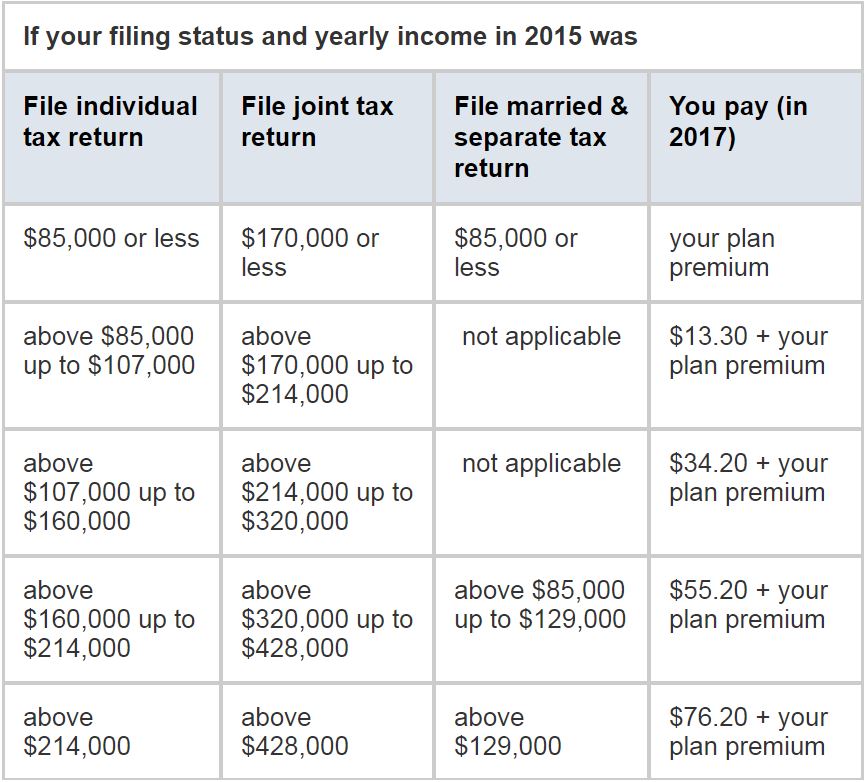

Additionally, some people pay an income-related premium. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare. The total Medicare Part B premiums for high income beneficiaries for 2017 are shown in the following table:

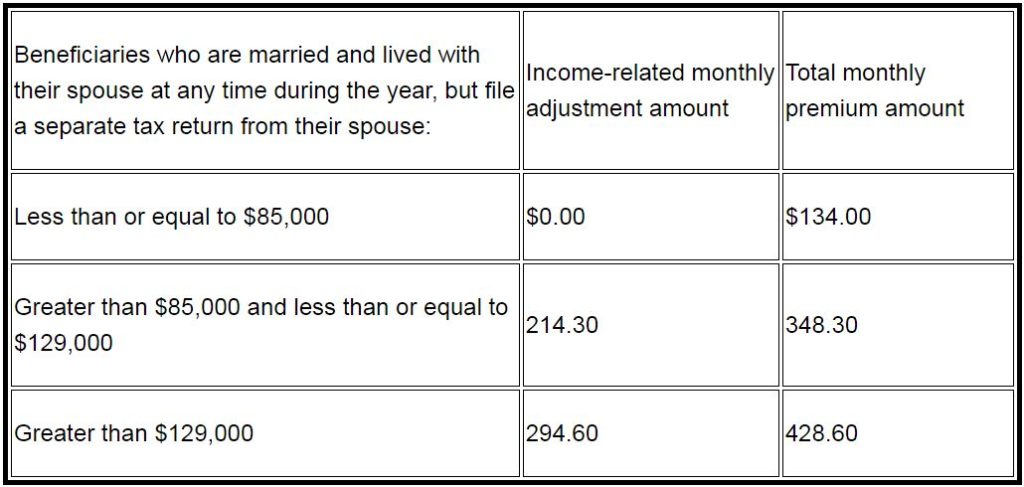

Premiums for beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

Late enrollment penalty:

In most cases, if you don’t sign up for Part B when you’re first eligible, you’ll have to pay a late enrollment penalty for as long as you have Part B. Your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it. Also, you may have to wait until the General Enrollment Period (from January 1 to March 31) to enroll in Part B, and coverage will start July 1 of that year.

WHAT TYPE OF GAPS EXIST IN MY MEDICARE COVERAGE?

You’ve paid for Medicare A all your life, and you pay a monthly premium for Medicare Part B when you receive it, but Medicare still doesn’t cover all of your medical expenses…far from it. Your Part A hospital coverage and Part B medical coverage have some significant gaps, and your prescription drug coverage needs to be purchased separately. Below is some information about your cost-sharing requirements under Original Medicare.

Part A costs if you have Original Medicare

Medicare Part A covers the cost for inpatient hospital or mental health facility stays, skilled nursing facilities, home health care, and hospice. However, there are some pretty significant cost-sharing requirements. These gaps in your coverage can easily cost tens of thousands of dollars. To limit their out-of-pocket exposure and protect themselves financially, most people choose to purchase a Medicare Supplement or sign up for a Medicare Advantage plan.

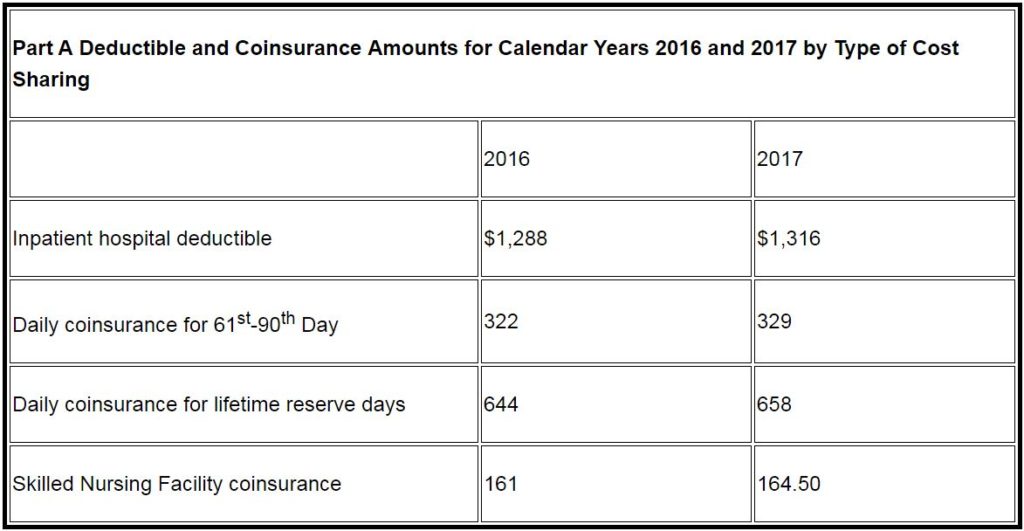

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. Beneficiaries must pay a coinsurance amount of $329 per day for the 61st through 90th day of hospitalization ($322 in 2016) in a benefit period and $658 per day for lifetime reserve days ($644 in in 2016). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $164.50 in 2017 ($161 in 2016).

- Hospital inpatient stay

- $1,316 deductible for each benefit period.

- Days 1–60: $0 coinsurance for each benefit period.

- Days 61–90: $329 coinsurance per day of each benefit period.

- Days 91 and beyond: $658 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime).

- Beyond lifetime reserve days: all costs.

- Note: You pay for private-duty nursing, a television, or a phone in your room. You pay for a private room unless it’s medically necessary.

- Mental health inpatient stay

- $1,316 deductible for each benefit period.

- Days 1–60: $0 coinsurance per day of each benefit period.

- Days 61–90: $329 coinsurance per day of each benefit period.

- Days 91 and beyond: $658 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime).

- Beyond lifetime reserve days: all costs.

- 20% of the Medicare-approved amount for mental health services you get from doctors and other providers while you’re a hospital inpatient.

- Note: There’s no limit to the number of benefit periods you can have when you get mental health care in a general hospital. You can also have multiple benefit periods when you get care in a psychiatric hospital. Remember, there’s a lifetime limit of 190 days.

- Skilled nursing facility stay

- Days 1–20: $0 for each benefit period.

- Days 21–100: $164.50 coinsurance per day of each benefit period.

- Days 101 and beyond: all costs.

- Home health care

- $0 for home health care services.

- 20% of the Medicare-approved amount for durable medical equipment.

- Hospice care

- $0 for hospice care.

- You may need to pay a copayment of no more than $5 for each prescription drug and other similar products for pain relief and symptom control while you’re at home. In the rare case your drug isn’t covered by the hospice benefit, your hospice provider should contact your Medicare drug plan to see if it’s covered under Part D.

- You may need to pay 5% of the Medicare-approved amount for inpatient respite care.

- Medicare doesn’t cover room and board when you get hospice care in your home or another facility where you live (like a nursing home).

Part B costs if you have Original Medicare

Medicare Part B covers doctor visits both in and out of the hospital and a lot of other outpatient services, including outpatient surgeries, labs and X-rays, home health services, durable medical equipment, and more. The problem is that you pay 20% of the bill for these services with no out-of-pocket limit, and you could pay more if your doctor doesn’t “accept assignment.” A Medicare Supplement or Medicare Advantage plan can fill in some of these gaps and limit your cost-sharing exposure.

- Part B annual deductible:

- You pay $183 per year for your Part B deductible.

- Clinical laboratory services:

- You pay $0 for Medicare-approved services.

- Home health services:

- $0 for home health care services.

- 20% of the Medicare-approved amount for durable medical equipment.

- Medical and other services:

- You pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you’re a hospital inpatient), outpatient therapy, and durable medical equipment.

- Note: In 2017, there may be limits on physical therapy, occupational therapy, and speech language pathology services. If so, there may be exceptions to these limits.

- Outpatient mental health services

- You pay nothing for your yearly depression screening if your doctor or health care provider accepts assignment.

- 20% of the Medicare-approved amount for visits to a doctor or other health care provider to diagnose or treat your condition. The Part B deductible applies.

- If you get your services in a hospital outpatient clinic or hospital outpatient department, you may have to pay an additional copayment or coinsurance amount to the hospital. This amount will vary depending on the service provided, but will be between 20-40% of the Medicare-approved amount.

- Partial hospitalization mental health services:

- You pay a percentage of the Medicare-approved amount for each service you get from a doctor or certain other qualified mental health professionals if your health care professional accepts assignment.

- You also pay coinsurance for each day of partial hospitalization services provided in a hospital outpatient setting or community mental health center, and the Part B deductible

- Outpatient hospital services

- You generally pay 20% of the Medicare-approved amount for the doctor or other health care provider’s services, and the Part B deductible applies.

- For all other services, you also generally pay a copayment for each service you get in an outpatient hospital setting. You may pay more for services you get in a hospital outpatient setting than you would pay for the same care in a doctor’s office.

- For some screenings and preventive services, coinsurance, copayments, and the Part B deductible don’t apply (so you pay nothing).

WHAT IS A MEDICARE SUPPLEMENT AND WHY DO I NEED ONE?

A Medicare supplement, also known as a Medigap plan, fills in some of the gaps in your Medicare hospital (Part A) and medical (Part B) coverage. When you receive Medicare-covered services, Medicare pays first, then the supplement pays some or all of the remaining costs. The nice thing about a supplement is that there are no network restrictions – you can go to any doctor or hospital that accepts Medicare, and no referrals are required.

There are ten standardized Medicare supplement plans, which means that a Plan F from one insurance company, for instance, will cover the same expenses as a Plan F from another insurance company. When you first sign up for Medicare Part B, regardless of age, you have 6 months to purchase a Medicare supplement without answering any medical questions; after that, any application or changes you want to make may require medical approval.

WHAT IS MEDICARE PART D AND HOW MUCH DOES IT COST?

Medicare Parts A and B, also known as Original Medicare, don’t provide coverage for most prescription drugs. To get help with the cost of your medications, you’ll need to purchase a Medicare Part D prescription drug plan.

Part D drug coverage can be purchased as a stand-alone plan to accompany Medicare + a supplement or can be incorporated into a Medicare Advantage plan. Either way, there are a lot of options. And while there are a number of similarities between many of the drug plans offered, there are also some factors to consider when deciding which plan is best for you, including the plan’s drug formulary, the monthly premium, the copayments and/or coinsurance you’re required to pay at the pharmacy, and the reputation of the insurance company.

Unlike a Medicare supplement plan, you can change Part D plans annually during the Annual Election Period (AEP) without having to qualify for the coverage.

Part D premiums by income

The charts below show your estimated prescription drug plan monthly premium based on your income as reported on your IRS tax return from 2 years ago and last year. If your income is above a certain limit, you’ll pay an income-related monthly adjustment amount in addition to your plan premium.

WHAT IS A MEDICARE ADVANTAGE PLAN?

Medicare Advantage plans are health plans offered by private insurance companies that contract with Medicare to provide Part A hospital and Part B medical benefits to people with Medicare who enroll in the plan. Many of these plans also provide Medicare Part D coverage and are known as Medicare Advantage Prescription Drug (MAPD) plans. Medicare Advantage plans must cover all of the services covered by Original Medicare and may offer additional services, like vision, dental, or hearing coverage.

In contrast with Medicare plus a supplement, Medicare Advantage plans look more like the health plans people may have had through their employer or purchased in the individual market. They typically have set-dollar copayments for services like doctor visits and may have an annual deductible for higher-cost services like hospital visits or outpatient surgery. They also may require members to obtain services from contracted network providers and obtain a referral from their primary care physician to see a specialist.

For Medicare beneficiaries whose doctors participate in the provider network, Medicare Advantage plans can offer better coverage than Medicare alone and a cost-effective alternative to a Medicare supplement.