For most employers, health insurance is the most important benefit they can offer to their employees. It serves as a great recruitment and retention tool, and while it can sometimes make business owners and HR managers want to pull their hair out, they also realize that their workers appreciate and may even expect it. Still, finding budget-friendly options your employees actually want can be a challenge. So can keeping up with all the plan changes and compliance requirements created by the Affordable Care Act. And explaining everything in a way your employees will actually understand may be the most difficult task of all. Fortunately, we can help with all of that.

JME Insurance Agency can help you with all of your employee benefits needs.

Click the icons below for more information or give us a call at 972.245.0266.

WHY JME

GET A QUOTE

To get a group quote, simply contact our office at 972-245-0266. JME will educate you on the most current industry trends, present your options in a simplified format, an make recommendations based on the unique needs of your company and your employees.

OFFERING A FULL RANGE OF EMPLOYEE BENEFITS

Health Insurance

For decades, companies large and small have offered group health insurance to their employees. Not only does a good health plan help a company attract and retain quality employees, it can create a healthier, more productive workforce.

The amount an employer spends on group health insurance is, of course, tax deductible as a business expense. Additionally, any amount an employee pays for health insurance and other benefits through a section 125 Premium Only Plan lowers the employee’s taxable income and, thus, lowers the employer’s payroll taxes.

Employees do appreciate the benefits their companies offer, especially the group health plan, and benefit not only from the employer contribution to premium but also from the company’s buying power—employees and their family members often end up with a better plan for a lower price than they could obtain in the individual market.

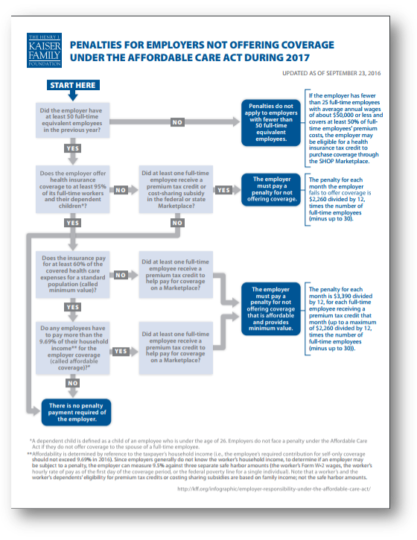

For all these reasons, most employers have tried to hang on to their group health plans even as premiums increase on an annual basis. The Affordable Care Act, which was signed into law back in 2010, has certainly had an impact on those premiums, but it affects employer plans in many other ways. Large employers, for instance, are now required to offer coverage to full-time employees or face a big tax penalty. With the employer mandate requirement, the definition of “full-time employee” has changed as well to include all employees working 30 hours per week or more. There are also new compliance and reporting requirements that are confusing and frustrating to employers.

In short, there are a lot of great reasons for a company to offer health insurance to its employees, but it’s also a lot more costly and time-consuming than it used to be. That’s why employers need a great benefits advisor that can help them find the right plan or plans for their employees while making sure they’re complying with all of the new laws.

At JME Insurance Agency, we’re employee benefits experts. Our experiences agents can help your company not only with your group health plan but with all of your employee benefits needs. Contact us today to learn more.

Dental Insurance

Next to health insurance, dental insurance is probably the most popular employee benefit, and for that reason it’s something every employee should at least consider.

While many employees are healthy and may rarely use their health coverage, almost all employees—along with their family members—take advantage of the dental benefit. At about a tenth of the price of health insurance, group dental coverage is a great way for a company to spend its benefits dollars.

There are a number of great dental insurance companies to choose from, and the plan designs range from preventive only to comprehensive DHMO (dental health maintenance organizations) with contracted provider networks to passive PPOs and indemnity plans. The covered benefits, waiting periods, and annual maximums also differ from plan to plan, which can make it confusing for a company to compare all its options.

JME Insurance Agency can help simplify this process. Our licensed agents will explain how dental insurance works, shop the market and present you with a number of options, and help you select a plan that’s right for your employees. Learn more.

Life & Disability Insurance

One of the best ways a company can use its group buying power is to purchase life and disability insurance for its employees. A lot of people don’t have any life insurance, even though everyone needs it, and those that do have it usually don’t have enough. Even fewer people have disability coverage, even though a short- or long-term disability can be financially devastating for a family.

The good news is that group life and disability insurance is very budget-friendly. It’s a great way for a company to round out its benefit package and make sure that its employees are taken care of.

JME Insurance Agency works with several leading life and disability insurance companies, and we would be happy to talk with you about your options. Learn more.

Tax Favored Accounts

There are three types of tax-advantaged accounts employers can set up to help their employees with their eligible medical expenses. Each of these accounts has certain advantages, but there are also rules about how to set up and administer the accounts. That’s why JME Insurance works with some great third party administrators (TPAs) to make sure your plan is set up correctly and beneficial for your employees. Learn more.

WHAT OUR CLIENTS ARE SAYING

HAVE QUESTIONS? ASK THEM HERE

EMPLOYEE BENEFITS UPDATES

IRS Announces HSA, ACA Limits for 2023

Deductible and Out-of-Pocket Limits The Internal Revenue Service has announced the deductible, out-of-pocket, and contribution limits for HSA-qualified plans for the 2023 calendar year. The minimum deductible increased from $1,400 to $1,500 for people with single coverage and from $2,800 to $3,000 for people with family coverage, compared with 2022.…

BCBSTX Settlement Information

Employers who sponsored and employees/individuals who enrolled in a Blue Cross Blue Shield of Texas health plan between 2008 and 2020 may have recently received (or should soon be receiving) a communication by mail or by email about a possible settlement in a class-action lawsuit. Below is some information from…

Paperwork Requirements for a Small Group Health Plan – Do You Qualify?

Download this article as a white paper As premiums continue to increase in the individual market, a lot of people are looking for other solutions. One option that may be available to you if you own a business is to purchase a small group policy. Why Small Group Coverage is…

Good News and Great News about the BCBSTX provider networks

We’re excited to pass along two big announcements from Blue Cross Blue Shield of Texas (BCBSTX) concerning the provider networks on its HMO and PPO plans. You may receive communication directly from BCBSTX as well. Agreement Reached with Texas Health Resources First, an announcement that will affect all BCBSTX members:…

New Password Requirements for Blue Access for Members

How to Determine if an Employer is an Applicable Large Employer (ALE)

This information was copied from the IRS.gov website. Basic Information Two provisions of the Affordable Care Act apply only to applicable large employers (ALEs): The employer shared responsibility provisions; and The employer information reporting provisions for offers of minimum essential coverage Whether an employer is an ALE is determined each…

Why Are Health Insurance Premiums for Children So High?

We've received a lot of questions and concerns from our individual and small group clients about the big jump in rates for their 2018 renewals. While there are several contributing factors (insurance trend/inflation, everyone's a year older than they were last year, etc.), the number one reason for the premium…

Important Information about the Employer Reporting Requirements under the Affordable Care Act

As we begin a new year, this is a good time for a quick reminder about the Form 1094 and 1095 employer reporting requirements under the Affordable Care Act. The deadline for the 1095 reports that must be provided to your employees has been extended to March 2, but the…

Employer Newsletter – March, 2017

With the first few weeks of 2017 now behind us and a new administration in the White House, we thought this would be a good time for a quick update. Here are few items that you’ll want to be aware of: Health Reform and the New Administration We know a…

WHITE PAPERS & INFOGRAPHICS

At JME Insurance Agency, we’re committed to educating our clients about issues that are important to them. Below you will find a number of white papers and other resources that are designed to provide JME’s employer clients with information to help them save money, stay compliant, and get more return from their employee benefits package.

NEWSLETTERS

To keep our employer clients up-to-date on issues important to them, JME sends out regular employer newsletters. We don’t send them every month but choose to wait until we have something to tell you. You can expect the newsletters to increase as we get closer to open enrollment. If your inbox is full and you’d prefer not to receive the newsletters by email, each one has an “unsubscribe” button. You can always find archived versions here in the Employer Resource Center.