The Affordable Care Act provides premium tax credits for individuals and families with incomes up to 400% of the Federal Poverty Level who are not eligible for other minimum essential coverage through an employer or a government program. The tax credit caps the amount a family would pay for the second-lowest-prices silver-level plan in the individual marketplace depending on the family’s income as a percentage of the Federal Poverty Level.

Additionally, the Children’s Health Insurance Program bases its eligibility requirements on the family’s income as a percentage of the Federal Poverty Level.

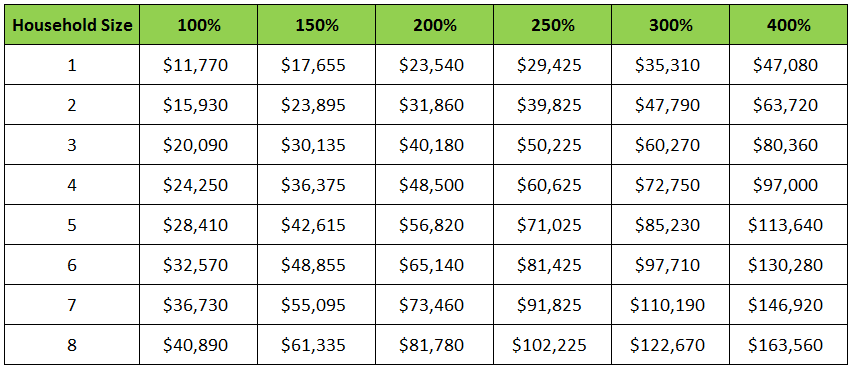

The below chart shows the Federal Poverty Levels for various incomes and household sizes for 2015. The 2016 FPL figures should be available in late January.

2015 Federal Poverty Levels for the 48 Contiguous States and the District of Columbia

The Federal Poverty Level is higher in Alaska and Hawaii.

Source: ASPE (Office of the Assistant Secretary for Planning and Evaluation)