As a result of the King v. Burwell Supreme Court case, most people have now heard of premium tax credits, the financial assistance available to individuals and families with incomes up to 400% of the Federal Poverty Level (FPL) who do not have access to other minimum essential coverage. These tax credits are available in all 50 states, regardless of whether the state set up its own insurance exchange website or not.

There’s another type of financial assistance, though, that’s available to people with incomes up to 250% of the Federal Poverty Level: cost-sharing subsidies.

What is a cost-sharing subsidy?

In the same way that the government pays a portion of your health insurance premiums if you qualify for a premium tax credit, the government will pay a portion of your out-of-pocket expenses if you qualify for a cost-sharing subsidy. The subsidy helps people in two ways:

- It reduces the out-of-pocket (OOP) limit on the plan. In 2016, the out-of-pocket limit for people with single coverage is $6,850, but people with cost-sharing subsidies can qualify for an OOP-max reduction of 20% for those with incomes between 200 and 250% of the FPL and a reduction of two-thirds for people with incomes between 100 and 200% of the FPL. That means that the out-of-pocket maximum would be $5,480 or $2,283 depending on the household income.

- It increases the actuarial value (AV) of the plan. In the silver-level of the marketplace, plans have an actuarial value of 70%, meaning that the plan, on average, pays 70% of the claims costs while the member would be responsible for 30%. Instead of a 70% actuarial value, people who qualify for cost-sharing subsidies will have plans with an AV of 73, 87, or 94% depending on their income.

How do you get a cost-sharing subsidy?

This is easy. When purchasing coverage in the individual marketplace, those with qualifying income levels will have the option to select plans with these reduced cost-sharing amounts. These plans are only available, though, in the silver level of the marketplace. This means that, even though lower-cost bronze-level plans are available, as are “off-exchange” plans, the cost-sharing assistance cannot be applied to these policies. If you’re willing to pay a little higher premium for a silver-level plan, you can get significantly better coverage.

During the first two open enrollment periods, silver-level plans were by far the most popular, indicating that a lot of people with qualifying incomes are taking advantage of this option.

How much is 250% of the federal poverty level?

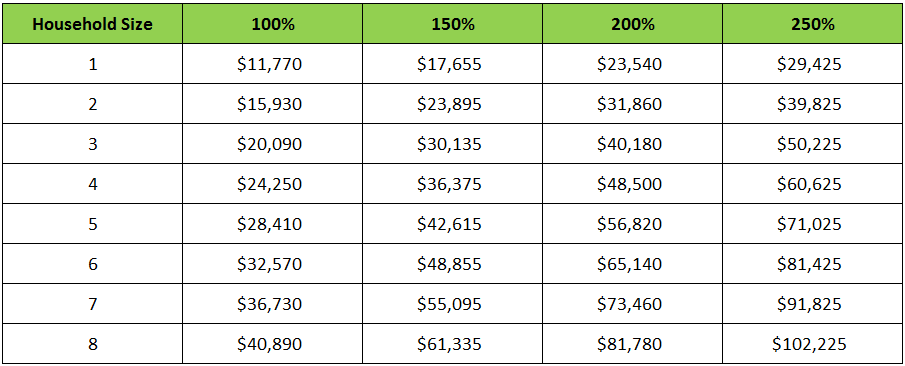

To qualify for a cost-sharing subsidy, you’d need to have a household income between 100% and 250% of the federal poverty level. This is determined by both your household income and your family size, as illustrated in the below chart.

Federal Poverty Levels for 2015 (48 contiguous states and D.C.)

I think I qualify. How can I get a quote?

If you believe you qualify for a cost-sharing subsidy, you’ll need to sign up during the annual open enrollment period (November 1, 2015 through January 31, 2016 for the 2016 plan year) or a special enrollment period.

To get a quote, you can contact one of JME’s licensed health insurance professionals.