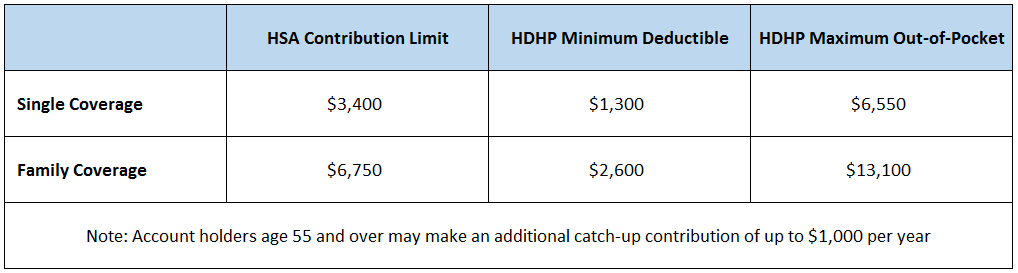

The IRS recently announced the 2017 contribution, deductible, and out-of-pocket limits for HSA-qualified plans. As it turns out, only one number changed from 2016: the contribution limit for people with single coverage under a High Deductible Health Plan increased by $50 from $3,350 to $3,400. All other limits remained the same.

- Annual contributions to an HSA may not exceed $3,4000 for self-only coverage and $6,750 for family coverage (individuals age 55 or older may contribute an additional $1,000 if desired).

- The annual deductible for a qualified high-deductible health plan must be at least $1,300 for self-only coverage or $2,600 for family coverage.

- The annual out-of-pocket limitations (deductibles, co-payments and co-insurance) may not exceed $6,550 for self-only coverage or $13,100 for family coverage. (For non-HSA-compatible ACA-compliant plans, the annual in-network maximum out of pocket is $6,850 for single coverage and $13,700 for family coverage.

It is important to note that the out-of-pocket maximum for HSA-qualified High Deductible Health Plans is different from the out-of-pocket maximum for plans under the Affordable Care Act. Those are increasing from $6,850 for single coverage and $13,700 for family coverage in 2016 to a whopping $7,150 for single coverage and $14,300 for family coverage in 2017. What this means is that it is possible to purchase health coverage in which the individual and family stop-loss limits are too high to contribute to an Health Savings Account.