While Medicare will provide some coverage for your medical bills, it was never intended to pay for all of your expenses. A hospital stay, prolonged outpatient treatment, or expensive monthly prescription could be financially devastating if you are relying on Medicare alone. Fortunately, there are some options. Medicare supplements, Medicare Part D coverage, and Medicare Advantage Prescription Drug plans can all help limit your exposure to big out-of-pocket expenses.

JME can help! The experienced agents at JME Insurance Agency can help you navigate the multitude of insurance plans available to determine which one is right for you.

Medicare Resources

Click the links below to learn more about your Medicare options.

Understanding Medicare

Medicare is a federal health insurance program for people age 65 and older, and for some younger individuals with certain disabilities. While it provides essential coverage, Medicare doesn’t pay for everything—which is why many people choose to add coverage that helps fill in the gaps.

The Basics

Medicare has several parts:

-

Part A covers hospital care, skilled nursing facilities, hospice, and some home health care. Most people don’t pay a premium for Part A.

-

Part B covers doctor visits, outpatient services, preventive care, and durable medical equipment. The standard monthly premium for Part B in 2025 is $185, though individuals with higher incomes may pay more, based on their income from two years prior.

-

Part D provides prescription drug coverage through private insurance companies.

-

Medicare Advantage (Part C) combines Parts A and B (and often Part D) into a single plan through a private insurer. These plans may include extra benefits like dental or vision, but typically come with provider networks and cost-sharing structures.

Applying for Medicare

Most people are automatically enrolled in Parts A and B when they turn 65 and are already receiving Social Security. If not, you’ll need to sign up during your Initial Enrollment Period, which begins three months before the month you turn 65 and lasts for a total of seven months.

You can enroll at ssa.gov/medicare, by calling Social Security, or by visiting a local office.

What Medicare Doesn’t Cover

Original Medicare doesn’t cover everything. There are no out-of-pocket maximums, and you’re responsible for deductibles, coinsurance, and copays. It also doesn’t include routine dental, vision, hearing, or long-term care. That’s why most people choose to enroll in additional coverage.

Your Options for Additional Coverage

You have two main options to help pay for what Medicare doesn’t:

-

Medicare Supplement Insurance (Medigap) + Part D

Medigap plans help cover the deductibles and coinsurance left over by Medicare. You’ll also need a standalone Part D plan for prescription drug coverage.

We typically recommend Plan G, which covers nearly every gap in Original Medicare—except for the small annual Part B deductible ($257 in 2025). It’s a popular choice because it offers predictable costs and comprehensive coverage.With a supplement like Plan G, you can see almost any doctor or hospital in the U.S. that accepts Medicare—no network restrictions, no referrals required.

-

Medicare Advantage Plans (Part C)

These plans bundle your hospital, medical, and often prescription drug coverage into one plan. They may include additional benefits like dental or vision, but usually have network requirements.

While we don’t sell Medicare Advantage plans directly, we understand they can be a good fit for some individuals and are happy to refer you to someone we trust if you’re interested in exploring those options.

Who We Recommend

For Medicare Supplement plans, we often recommend Blue Cross and Blue Shield of Texas (BCBSTX). Our clients have had consistently good experiences with BCBSTX. They offer reliable coverage, strong customer service, and a history of moderate rate increases—which matters when you’re looking for long-term peace of mind.

Frequently Asked Questions

Medicare is a federal health insurance program primarily for people aged 65 and older, although some younger individuals with certain disabilities or conditions may also qualify. It helps cover hospital stays, doctor visits, and other medical services. There are different parts of Medicare that work together—or with other coverage—to help you manage your health and medical costs.

Medicare Part A helps pay for inpatient care in hospitals, skilled nursing facilities (after a hospital stay), hospice care, and some home health services. Most people don’t pay a premium for Part A if they or their spouse worked and paid Medicare taxes for at least 10 years.

If you’re already receiving Social Security or Railroad Retirement benefits, you’ll usually be enrolled in Part A automatically at age 65. Most people don’t pay a premium, but if you haven’t paid enough into Medicare, you may have to buy it. Even with premium-free Part A, you’ll still be responsible for deductibles and coinsurance when you use it.

Part B covers outpatient care like doctor visits, preventive services, lab work, durable medical equipment, and some home health services. It complements Part A by covering care outside the hospital. Most people pay a monthly premium for Part B, which is income-based.

You’ll be automatically enrolled in Part B if you’re already receiving Social Security benefits. If not, you’ll need to sign up during your Initial Enrollment Period. The standard monthly premium is $174.70 in 2025, but people with higher incomes may pay more. There’s also an annual deductible, after which Medicare generally pays 80% of approved services.

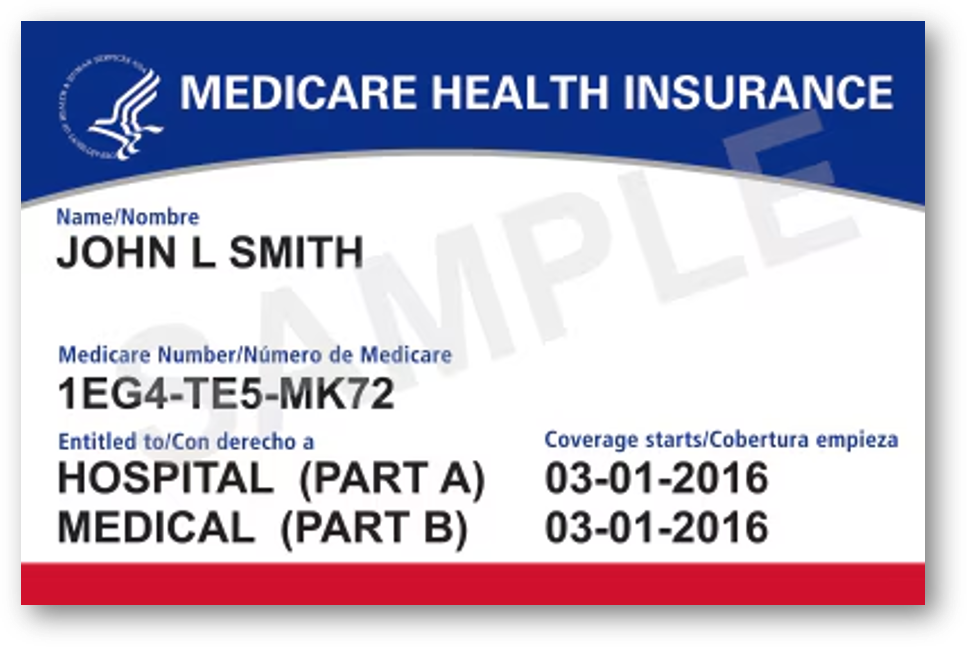

Your Medicare coverage typically begins the first day of the month you turn 65—if you sign up during the three months before your birthday month. Delaying enrollment can delay your coverage start date, so it’s important to understand your timeline and apply on time. If you’re automatically enrolled, you’ll get your Medicare card in the mail about three months before your coverage begins.

Original Medicare doesn’t cover everything. You’ll still pay deductibles, copays, and 20% of most medical bills. It also doesn’t cover most prescriptions, dental, vision, hearing aids, or long-term care. That’s why many people choose to add a Medicare Supplement and a Part D drug plan.

Medicare Part D provides prescription drug coverage through private insurance companies. Costs vary by plan and include monthly premiums, copays, and sometimes a deductible. You can get Part D as a standalone plan or bundled into a Medicare Advantage plan.