Health insurance is essential—but it doesn’t have to break the bank. Whether you get coverage through your employer, the Marketplace, or directly from an insurer, there are smart strategies to help reduce your monthly premiums and out-of-pocket expenses.

Here are five practical ways to cut your healthcare costs without cutting your coverage.

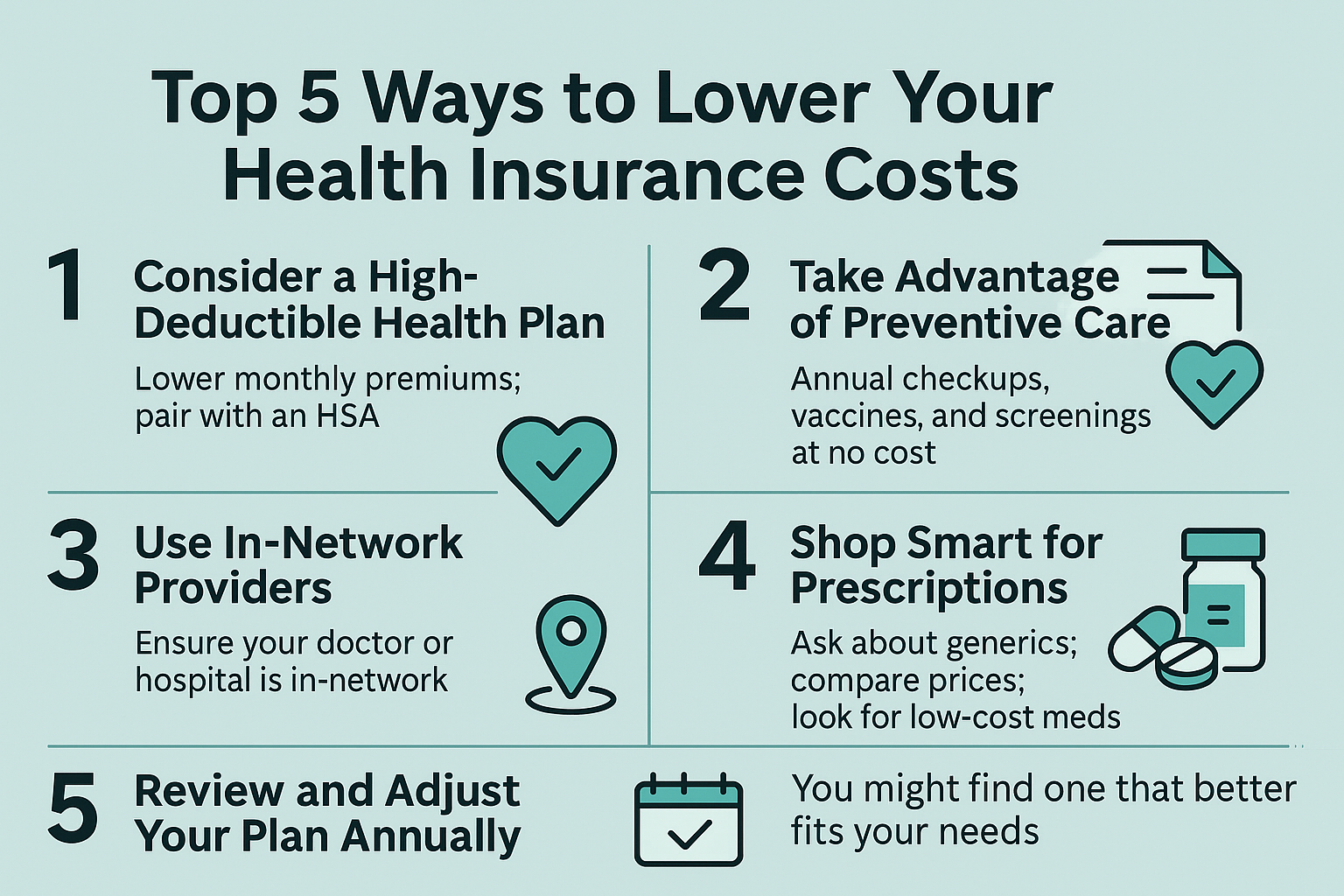

1. Consider a High-Deductible Health Plan (HDHP)

HDHPs often come with lower monthly premiums. Pairing one with a Health Savings Account (HSA) can give you a tax-advantaged way to cover medical expenses while saving for the future.

2. Take Advantage of Preventive Care

Most plans cover annual checkups, vaccines, and screenings at no cost. Staying on top of preventive care can help catch issues early—before they become expensive problems.

3. Use In-Network Providers

Going out-of-network can cost significantly more—or may not be covered at all. Always check that your doctor, clinic, or hospital is in-network before receiving care.

4. Shop Smart for Prescriptions

Ask your doctor about generic alternatives, use your plan’s preferred pharmacy, or compare prices using tools like GoodRx. Some pharmacies even offer common medications at low or no cost.

5. Review and Adjust Your Plan Annually

During Open Enrollment, don’t just renew the same plan automatically. Review your options—you might find one that better fits your current needs and saves you money.

Final Thoughts

Lowering your health insurance costs isn’t about taking shortcuts—it’s about making informed choices. With the right plan and a few smart habits, you can keep your healthcare affordable without sacrificing quality.